owe state taxes california

California residents - Taxed on ALL. Ad End Your IRS Tax Problems.

Do I Have To File State Taxes H R Block

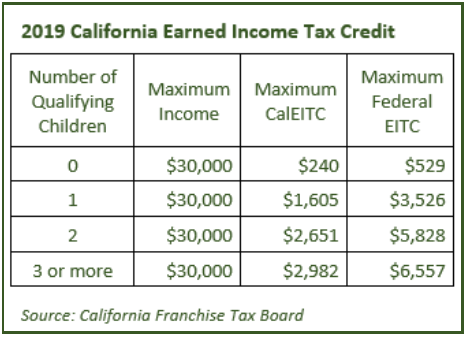

For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return.

. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other. For example if a. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600.

Possibly Settle For Less. Ad End Your IRS Tax Problems. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other.

BBB Accredited A Rating - Free Consult. You must file by the deadline to avoid a late filing penalty. How California taxes residents nonresidents and part-year residents.

Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. One of these is for state taxes. Free Confidential Consult.

Important State gas price and other relief proposals. There are 43 states that collect state income taxes. If you had money.

The deadline is October 17 2022. The state of California will require you to pay tax on the profit. In California the lowest tax bracket is.

The maximum penalty is 25. Whichever amount is less. Important State gas price and other relief proposals.

100 of the amount due. California for instance has the highest state income tax rate in the United States. Affordable Reliable Services.

If you do not owe taxes or have to file you may be able to get a refund. 073 average effective rate. If your tax return shows a balance due of 540 or less the penalty is either.

We give you an automatic 6-month extension to file your return. Ad See if you ACTUALLY Can Settle for Less. The California Franchise Tax Board only requires that you file for an extension if you owe California taxes.

It comes in fourth for combined income and sales tax. Free Confidential Consult. You can get up to 3027.

BBB Accredited A Rating - Free Consult. Cant Pay Unpaid Taxes. A 1 mental.

California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US. This can pay anywhere from 255 to 6728. Both personal and business taxes are paid to the state.

Affordable Reliable Services. Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. Take Advantage of Fresh Start Options.

If you are expecting a refund from California there is nothing to be filed an. 9 rows California state tax rates are 1 2 4 6 8 93 103 113 and 123. Businesses in the United States owe a portion of their profits to the government and this differs depending on what state theyre located in.

Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. Its tax sits at 133. Take Advantage of Fresh Start Options.

5110 cents per gallon of regular. If you qualify for the California Earned Income Tax Credit EITC 7. Possibly Settle For Less.

Cant Pay Unpaid Taxes. California State Tax Quick Facts. Ad See if you ACTUALLY Can Settle for Less.

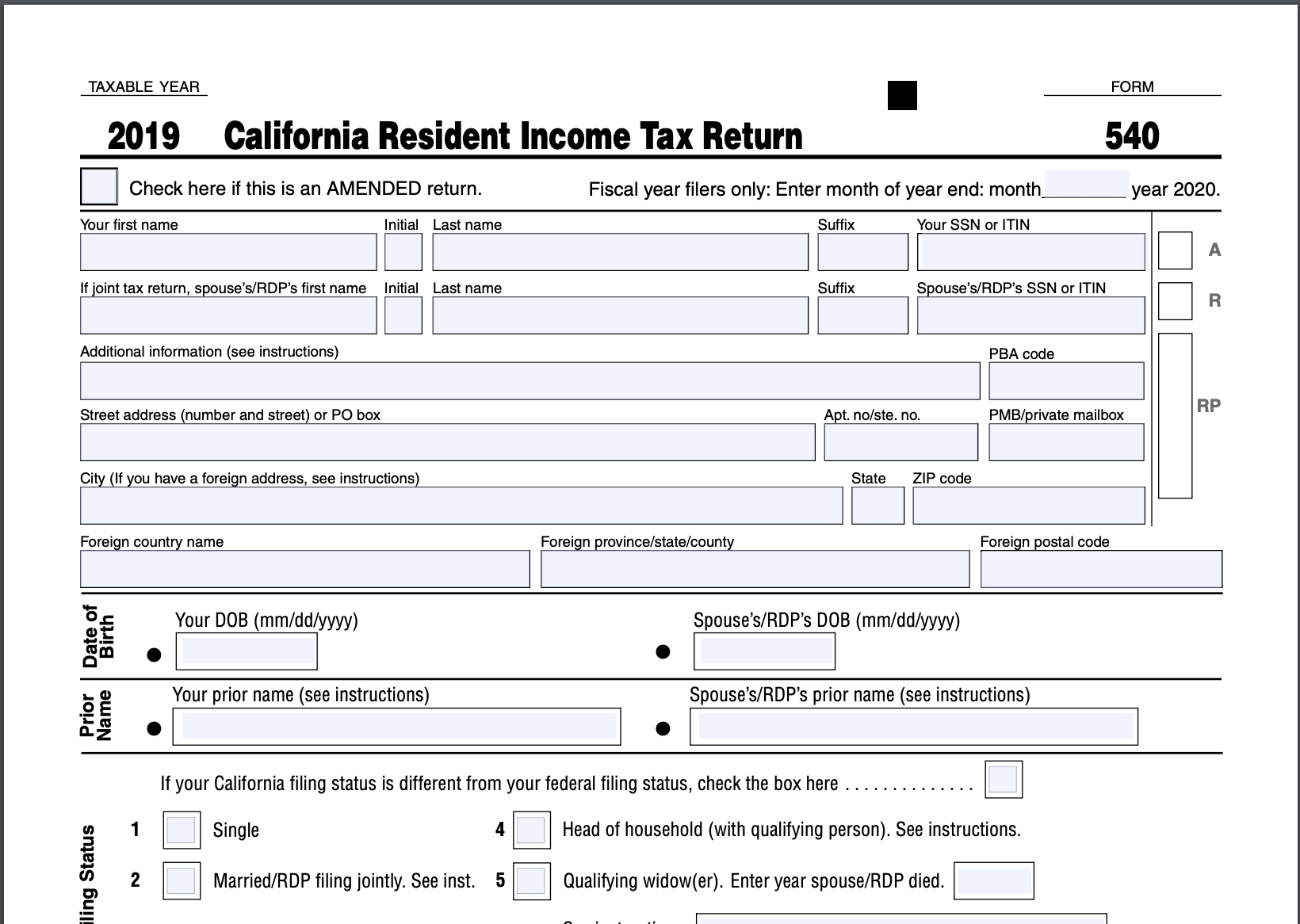

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

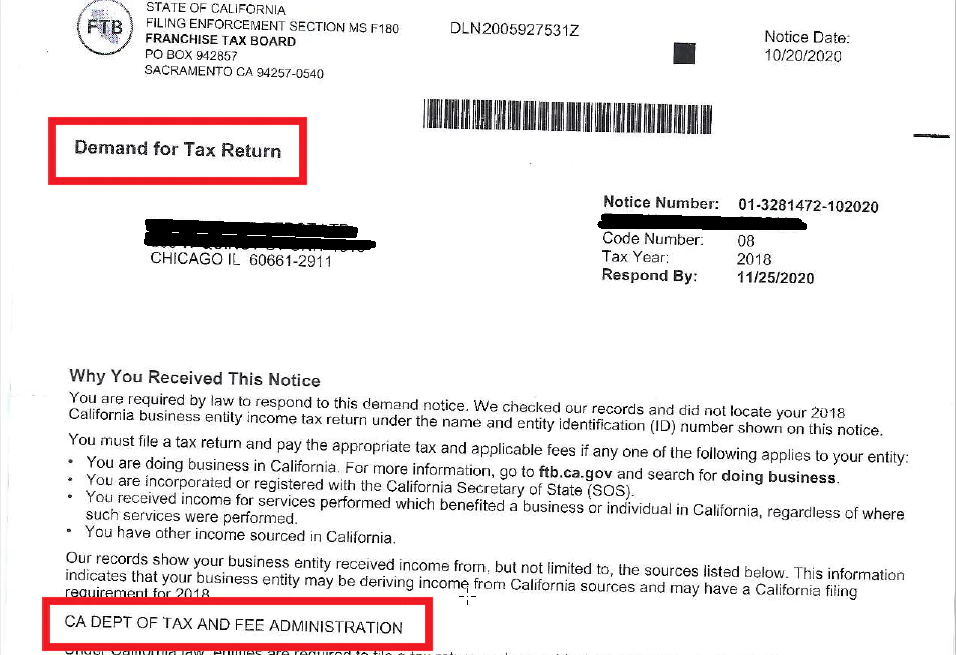

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

California Use Tax Information

Why Is My California Ca Tax Refund Taking So Long 2022 Payment Delay Updates Aving To Invest

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

California S Tax System A Primer

Where S My State Refund Track Your Refund In Every State Taxact Blog

I Owe California Ca State Taxes And Can T Pay What Do I Do

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Understanding California S Sales Tax

Understanding California S Sales Tax

Irs Form 540 California Resident Income Tax Return

What Are California S Income Tax Brackets Rjs Law Tax Attorney

California Ftb Rjs Law Tax Attorney San Diego

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent